estate tax exemption 2022 inflation adjustment

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to worry about having. The 2022 generation-skipping transfer tax GST tax exemption amount has.

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

For married couples the exclusion is now 24120000 million.

. This means that a married couple. 2021-45 with inflation adjustments for 2022 and consistent with earlier predictions the changes in the most significant federal estate and trust planning numbers will be as follows. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Following our September posting of a preview of the 2022 estate tax exemptions the IRS recently released the inflation-adjusted amounts that will apply in 2022. There is still a step-up in basis for inherited property and assets. As you contemplate your estate planning or making gifts during the new year here are the numbers that were published for 2022.

Code 482551 Voter Approval Rate Tax Code 2604 Exemptions Residence Homestead Exemptions Tax Code 1113 O65Disabled School Tax Ceiling Tax Code 1126 Freeport Tax Code 11251. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. The current estate and gift tax exemption of 2022 is 1206000000 or 2412000000 for a couple.

Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers. November 10 2021. The basic exclusion amount for determining the unified credit against estate tax will be 12060000 for decedents dying in calendar.

The majority of estates arent large enough to be charged a federal estate tax and as of 2022 estate taxes only apply if the decedents assets are worth more than 1206 million adjusted for inflation from 2021s 117 million. Under President Trump the credit was set at 11 million per person adjusted for inflation. Estate tax exemption 2022 inflation adjustment.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. The exemption for gifts and property is unified which means that it includes both taxable life gifts of an individual and taxable property in the event of death. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021.

Inflation Is Quietly Raising Middle Class Tax Bills Through Bracket Creep. The tax rate applicable to transfers above the exemption is currently 40. 2022 Exemptions and Exclusions.

The 2021 exemption amount was 73600 and phased out. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

The Rhode Island estate tax credit amount increases to 70490 in 2022 which effectively increases the estate tax threshold to 1654688 from 69515 and. The basic exclusion amount for estates of decedents who die during 2022 is 12060000 up from 11700000 for estates of decedents who died in 2021. At the federal level the estate tax is referred to as a unified credit meaning that the exclusion amount is the total amount excluded from taxes for taxable lifetime gifts plus gifts at death.

As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. The New York state estate tax exemption increases with inflation each year. The Internal Revenue Service will publish the official inflation adjustments in a Revenue Procedure that will probably appear in 4-8 weeks.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. The increase to the basic exclusion amount the BEA to 12060000 and the increase to the gift tax annual exclusion amount to.

From Fisher Investments 40 years managing money and helping thousands of families. The Internal Revenue Service has released Rev. Under President Obama the credit was set at 5 million per person adjusted for inflation.

The 2019 anti-clawback regulations were in response to the Tax Cuts and Jobs Act TCJA increase of the federal estate tax exemption from 545 million to 114 million for 2019 which is currently 1206 million in 2022 but drops back to an inflation-adjusted 5 million on January 1 2026. As of January 1 2022 that will be cut in half. First some background context.

Lower Estate Tax Exemption. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650.

The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. Code 48255 Maximum Compressed Tax Rate Edu. The Internal Revenue Service recently issued Revenue Procedure 2021-45 providing calendar year 2022 inflation adjustments for more than sixty tax provisions.

The base applicable exclusion amount and generation-skipping tax exemption will be 12060000 was 11700000 for 2021. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Estate Tax Exemption goes up for 2022. The Technical Analysis Patterns Cheat Sheet Is A Meta Trader Forex Sheet That Helps The Traders To. Estate and gift exclusions.

The estate and gift tax exemption amount has increased from 117 million per person to 1206 million per person in 2022. For couples the exclusion is now 2412 million. The annual exclusion for gifts is 16000 for calendar year 2022 up.

As this newsletter goes to press the 2022 exemption has not been announcedit was 5930000 in 2021. Two of these adjustments are of particular interest to estate planners. The amount is adjusted each year for inflation so.

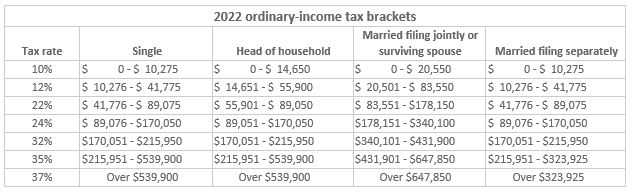

The Internal Revenue Service recently announced its annual inflation adjustments for tax year 2022 and many tax provisions have increased as a result. Types of Property Tax Relief Rate reduction State Compression Percentage Edu. The federal estate tax exemption for 2022 is 1206 million.

2022 Annual Adjustments for Tax Provisions. The federal lifetime gift tax exemption has been indexed for inflation and therefore increased from 11700000 in 2021 to 12060000 in 2022. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual exclusion amount for gifts.

The estate tax exemption is adjusted for inflation every year. Federal Estate Tax Exemption. The federal estate tax exemption is going up again for 2022.

2021 Cost Of Living Adjustment Numbers Efpr Group

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

2022 Tax Inflation Adjustments Released By Irs

Irs Releases Annual Inflation Adjustments For Tax Year 2022 Choate Hall Stewart Llp

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Tax Inflation Adjustments Released By Irs

Irs Inflation Adjustments For 2022 Tax Returns Bennett Thrasher

2022 Tax Inflation Adjustments Released By Irs

How Could We Reform The Estate Tax Tax Policy Center

Inflation Pushes Income Tax Brackets Higher For 2022

2020 Estate Planning Update Helsell Fetterman

Tax Related Estate Planning Lee Kiefer Park

What Are Estate And Gift Taxes And How Do They Work

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

How Could We Reform The Estate Tax Tax Policy Center

Irs Issues Inflation Adjustments For 2022 Tax Year

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Boulaygroup Com