nevada estate and inheritance tax

Nevada gift tax and inheritance tax planning. There are extreme cases where an estate will still need to pass through probate even if the decedent had.

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An I Inheritance Tax Nevada Tax Questions

No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on the number 7.

. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is. The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. Ad From Fisher Investments 40 years managing money and helping thousands of families.

The alternate valuation is only available if it will decrease both the gross amount of the estate and the estate tax liability. Nevada does not levy an inheritance tax. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1206 million in 2022 though.

Inheritance taxes are paid by the person receiving the money or property from someone else. Get Your Max Refund Today. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return.

Eight states and the District of Columbia are next with a top rate of 16 percent. Whereas estate taxes are due from the estate of the person who has died when the property is transferred to heirs and beneficiaries. Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in America.

Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax. Thats why Nevada is such a tax friendly state. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay.

This is a tax that is assessed when beneficiaries receive money from an estate. Estate tax of 306 percent to 16 percent for estates above 59 million. Their States Without an Estate Tax or Inheritance TaxA Guide to South Carolina Inheritance Laws - SmartAsset Mar 04 2020 Nevada does not charge estate or inheritance taxes.

Maryland imposes both an estate tax and an inheritance tax. No estate tax or inheritance tax. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

All Major Categories Covered. Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an inheritance tax you will have to pay it even though you live in Nevada. Does Nevada Have an Inheritance Tax or Estate Tax.

Then under legislation signed in March 2014 the state estate tax exemption was retroactively increased to 12 million for all 2014 deaths. No estate tax or inheritance tax. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut has the highest exemption level at 71 million.

Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an inheritance tax you will have to pay it even though you live in Nevada. Although it did have one prior to the year 2005 it has been phased out. The top inheritance tax rate is 16 percent no exemption threshold New Mexico.

Inheritance tax of up to 18 percent. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though. If no compensation was included in the will they can receive four percent of the first 15000 of the value of the estate.

In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax. Basically the difference between inheritance taxes and estate taxes is who is responsible for paying. Under Nevada law there are no inheritance or estate taxes.

No estate tax or inheritance tax. Like most states Nevada does not have an estate tax or an inheritance tax. The probate process is not required in Nevada if the decedent has set up a trust or family trust which in most cases helps their estate to avoid probate.

Nevada Inheritance Tax and Estate Tax. Select Popular Legal Forms Packages of Any Category. Nevada has no estate or inheritance tax.

However you should know that the inheritance tax of another state may apply to you if someone living in that state leaves you something in their will. Inheritance tax of up to 16 percent. They may get three percent of the next 85000 and two percent for anything over 100000.

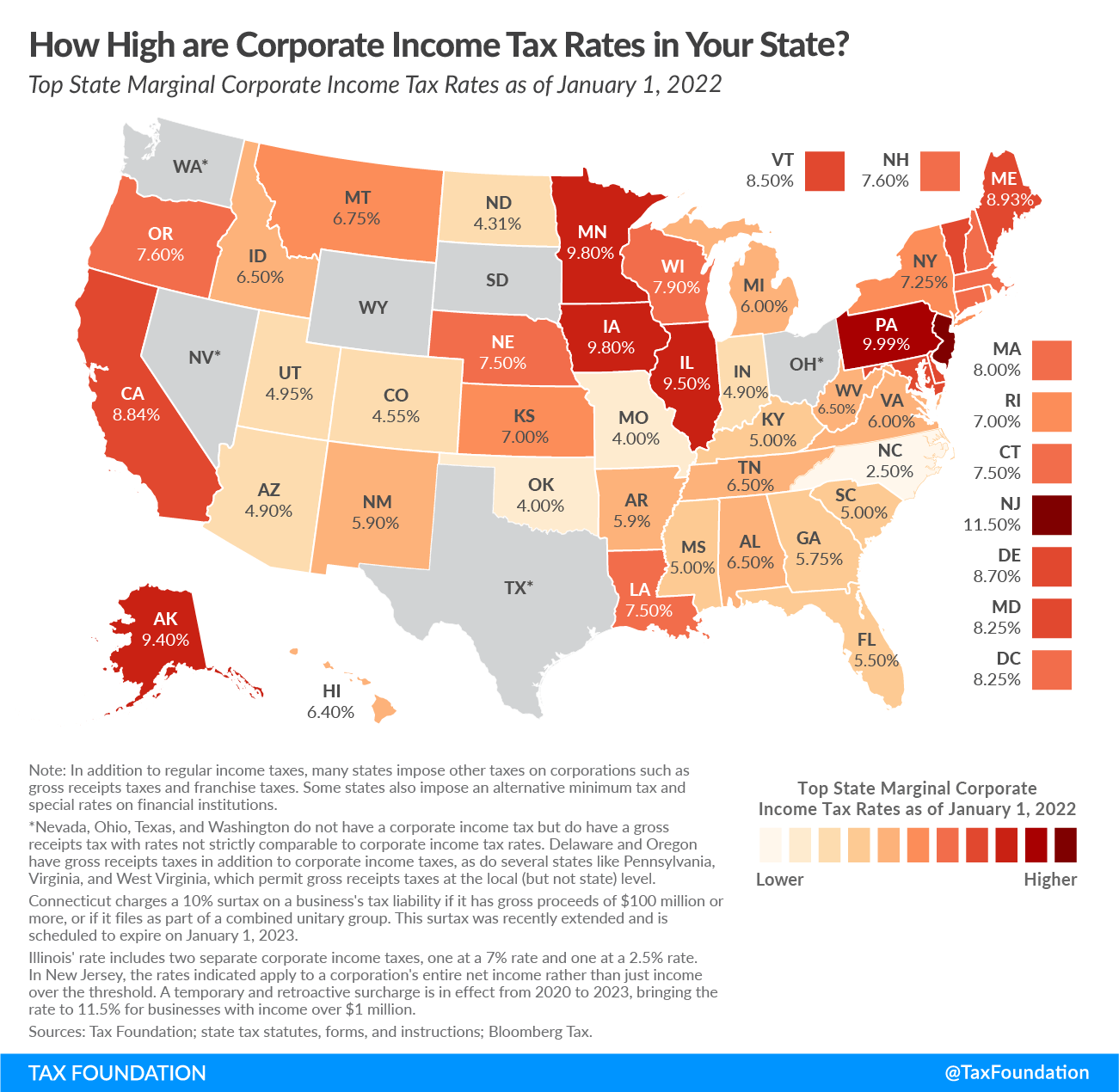

The estate tax laws vary from state. All inheritance are exempt in the State of Nevada. States that collect an inheritance tax as of 2021 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Chapter 150 of Title 12 of the Nevada Revised Statutes allows for compensation as outlined in the will. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing.

However if those trusts or plans were not made the only way estate assets can be distributed in Nevada is through the probate. The good news also is that the IRS does not impose an inheritance tax. The difference between inheritance and estate tax is a matter of who is responsible for paying the tax.

Ad Instant Download and Complete your Probate Forms Start Now. These 15 Countries Pay More in Taxes Than Americans. In this detailed guide of Nevadas inheritance laws we break down intestate succession probate what makes a will valid and moreIf.

Inheritance tax of up to 15 percent. Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. The top estate tax rate is 16 percent exemption threshold.

For use in protecting assets from taxes for generations. TurboTax Makes It Easy To Get Your Taxes Done Right. The federal estate tax exemption is 1118 million for 2018.

No Tax Knowledge Needed. 5740 million North Carolina. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

Estate tax of 10 percent to 16 percent on estates above 1 million. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Kentucky for instance has an inheritance tax that applies to all property located in-state even if the person inheriting the property is located out-of-state.

No estate tax or inheritance tax. Estate taxes are levied on the total value of a decedents property and must be paid out before distributions are made to the decedents beneficiaries. It is one of the 38 states that does not apply an estate tax.

The Federal estate tax only affects 02 of Estates. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

State estate and inheritance tax treatment of 529 plans. More on Money and Taxes.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Vs California Taxes Explained Retirebetternow Com

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Your Estate Plan Be Aware Of New Laws Estate Planning How To Plan New Law

Nevada Tax Advantages Luxury Real Estate Advisors

Nevada Tax Advantage Narteywilner Com

Greetings From Nevada Vintage Postcard Etsy Vintage Postcard Postcard Greetings

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Faced Earlier Taxing Situations Las Vegas Review Journal

Historical Nevada Tax Policy Information Ballotpedia

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Lamar Odom S Medical Debacle Offers Lessons On Estate Planning Investmentnews Lamar Odom Lamar Nba Stars

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An I Inheritance Tax Nevada Tax Questions